Unctad reports continued fall in global FDI during first semester of the year

Global investment projects dropped in 2025

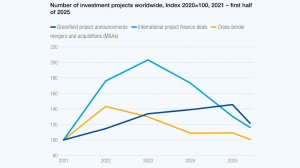

Photo by Unctad, based on information from The Financial Times, fDi Markets and LSEG Data & Analytics

UN Trade & Development, better known as Unctad, has reported, in its latest 'Global Investment Trends Monitor', that global foreign direct investment (FDI) fell by 3% during the first half of this year, year-on-year. This continued what was now a two-year “slump” (Unctad’s word) in FDI, caused by trade stresses, high interest rates and international political uncertainties.

“The drop was driven by developed economies, where cross-border mergers and acquisitions (M&As) – which normally make up a large share of their FDI – fell 18% to $173-billion,” pointed out Unctad. “Developing economies fared better overall, with flows remaining flat. But trends diverged by region. Inflows rose 12% in Latin America and the Caribbean and 7% in developing countries in Asia but fell 42% in Africa.”

While the number of greenfield projects increased worldwide by 7%, global international project finance fell by 8% and cross-border M&As dropped by 23%. With regard to developed economies, FDI fell by 7%, and, although greenfield projects jumped by 48%, international project finance plummeted by 32% and cross-border M&As by 18%. Concerning developing economies, they saw a zero per cent change in FDI, although a 37% drop in greenfield projects, while international project finance increased by 21%. There was no data on developing economy cross-border M&As.

Regarding developed regions, Europe saw a 25% fall in FDI, a 28% increase in greenfield projects, a 35% drop in international project finance and a 1% decline in cross-border M&As. North America experienced a 5% increase in FDI, a 79% jump in greenfield projects, a 36% fall in international project finance and a 23% drop in cross-border M&As. The category “other developed economies” recorded a 7% decline in FDI, a 23% increase in greenfield projects, a 12% reduction in international project finance and a 52% collapse in cross-border M&As.

Concerning developing regions, Africa (as noted above) saw a fall of -42% in FDI, and also experienced a -58% collapse in greenfield projects, but had a slight (1%) rise in international project finance; there was no data on cross-border M&As. Latin America and the Caribbean had a 12% increase in FDI, although greenfield projects were down 15%; international project finance rose 23% and cross-border M&As rocketed by 254%. Developing Asia saw FDI rise by 7%, but greenfield projects dropped by 20%; international project finance was up 29% but cross-border M&As collapsed by 67%.

“High borrowing costs and economic uncertainty continue to squeeze investment in industry and infrastructure in the first half of 2025,” noted Unctad. “Announcements of greenfield projects – when firms build new operations abroad – fell 17% in number, driven by a 29% decline in supply-chain-intensive manufacturing such as textiles, electronics and automotives, amid tariff uncertainty. International project finance – critical for infrastructure development – also declined, with deal numbers down 11% and value 8%.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation